What Happens If You Find Oil On Your Property

What To Do If You Find Oil On Your Land?

Imagine waking up one morning to discover there’s oil beneath your land – and suddenly needing to know what to do if you find oil.

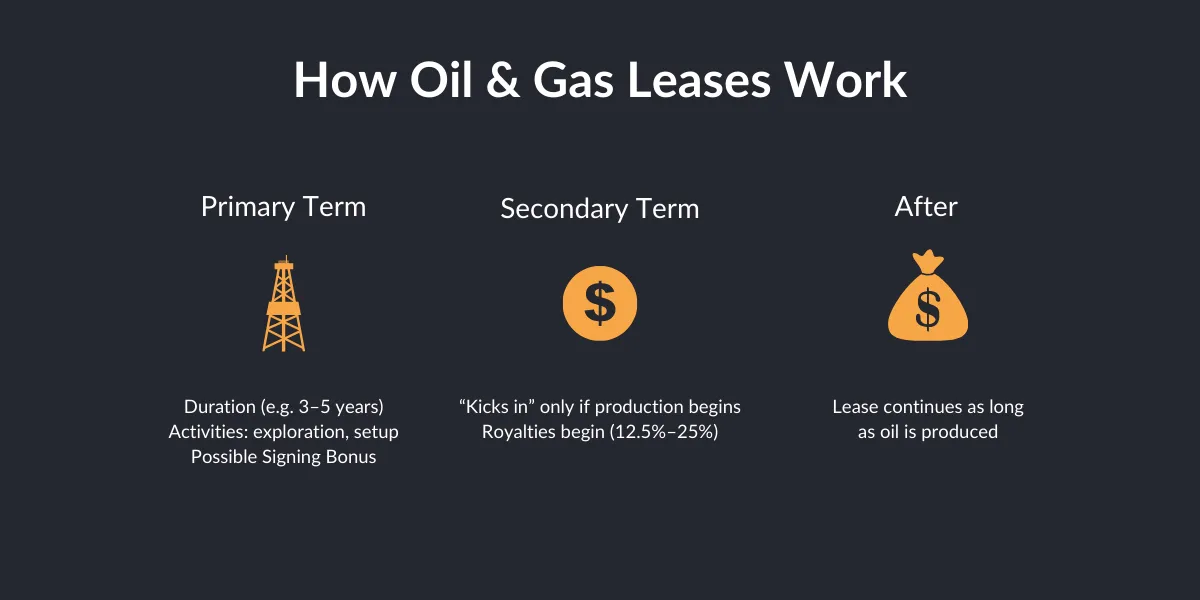

If you’re unsure what to do if you find oil, start by confirming whether you own the mineral rights — that’s what determines who can extract it and who profits. Without these rights, you may not have control over the oil. Next, conduct a title search to verify ownership, consult a mineral rights attorney, and assess the oil’s quality and quantity with experts. From there, you can lease, sell, or develop your oil reserves, each offering different financial opportunities. Leasing to an oil company can provide royalty payments ranging from 12.5% to 25% of the revenue from extracted oil, while selling your mineral rights can result in a large lump sum payout. If you choose to develop the oil yourself, you could earn millions over time, but it requires significant investment.

Knowing what to do if you find oil is essential to avoid costly mistakes and make the most of your discovery. With oil prices fluctuating, timing and expert guidance are key to maximizing your profits. In this guide, we’ll walk you through every step to ensure you make informed and lucrative decisions.

Assessing Ownership: What If Someone Else Owns The Oil?

Finding oil on your property is an exciting discovery, but it’s important to understand that this doesn’t automatically give you the right to extract or sell it. Ownership of surface rights (the land itself) and mineral rights (the resources beneath the surface) are often separate. Without mineral rights, you may not have legal control over the oil beneath your land. Here’s what you need to know to navigate this critical aspect.

What are Mineral Rights?

Mineral rights grant you the legal authority to extract and sell the minerals beneath your land. These rights are crucial for any oil extraction activities. If you own the mineral rights, you have the potential to profit from finding oil on your land, but without them, you cannot legally drill or sell the oil.

- Definition and Scope: Mineral rights typically cover resources such as oil, gas, coal, and metals but do not include surface resources like water, which are governed by different laws.

- Ownership Benefits: With mineral rights, you can lease them to an oil company, negotiate royalty payments, and have a say in how the resources are developed.

Historical Separation of Mineral and Surface Rights

It is not uncommon for mineral rights to have been separated from surface rights long before you acquired the property. This means that while you might own the land, someone else could own the minerals beneath it.

- Common Scenarios: A previous owner may have sold the mineral rights to an oil company or retained them while selling the surface rights. In some cases, mineral rights are passed down separately from the land itself.

- Implications: If someone else owns the mineral rights, they have the legal right to access your property to extract minerals. This can include bringing in equipment, drilling wells, and building access roads in order to find oil on your land and begin extraction. That’s why it’s essential to understand what to do if you find oil on your land—especially if you’re unsure of the mineral ownership situation.

What if I Don’t Own the Mineral Rights

If another party owns the mineral rights to your land, here’s what you can do:

- Contact the Owner: Reach out to the mineral rights owner to discuss potential arrangements. They may be willing to sell or lease the rights to you.

- Negotiate Terms: Work out an agreement that benefits both parties, ensuring you clearly understand your rights and obligations regarding oil extraction on your land.

How do I know if I have mineral rights?

To determine whether you own the mineral rights to your property, you need to conduct a thorough investigation:

- Property Deed: Review your property deed for any mention of mineral rights. A term like “fee simple” typically means you own both surface and mineral rights, but specific wording may indicate otherwise.

- Title Search: Conduct a title search at your local county records office to trace mineral rights ownership. This will reveal if the rights were sold, reserved, or leased by previous owners.

- County Records: Local government offices maintain detailed land transaction records. While clerks may help guide you, hiring a mineral rights specialist or attorney ensures accuracy.

- Professional Assistance: Because mineral rights ownership can be legally complex, consulting a professional can help you interpret documents, verify ownership, and understand your rights.

Knowing what to do if you find oil on your land begins with clarity on mineral rights ownership—without it, your ability to make decisions or profit may be limited.

Is It Better To Lease Or Sell My Mineral Rights?

If you confirm that you own the mineral rights, you have several options to profit from your oil discovery:

- Leasing: Many landowners lease their mineral rights to oil companies in exchange for royalty payments, which typically range from 12.5% to 25% of the oil revenue.

- Selling: Selling your mineral rights outright can provide an immediate lump sum payout, which may be beneficial if you prefer an upfront financial gain.

- Development: If you want to take full control, you can partner with extraction companies or invest in drilling infrastructure yourself, which could generate millions over time, depending on the oil reserves.

Understanding what to do if you find oil on your land is critical to making informed financial and legal decisions. Whether you own the mineral rights or need to negotiate with a rights holder, knowing your options will help you maximize the value of your oil discovery.

Legal Guidance for Landowners Who Find Oil

Navigating the legal landscape around oil discovery requires more than excitement—it demands clarity, preparation, and the right professional support. From verifying mineral rights to negotiating contracts, taking the correct legal steps early can make all the difference in protecting your interests and unlocking the full value of your land. If you’ve recently discovered oil or believe your property may contain reserves, understanding what to do if you find oil on your land—legally and financially—is essential.

Consult an Attorney

Mineral rights laws can vary greatly depending on your state and situation. An experienced oil and gas attorney can help you understand these laws and determine whether you’re positioned to lease, sell, or develop your mineral rights.

- Legal Protection: Your attorney can review all contracts, leases, and potential agreements to ensure they serve your best interests.

- Dispute Support: In cases of unclear ownership, overlapping claims, or unfavorable lease terms, legal support becomes vital in protecting your rights.

- Strategic Advice: A qualified legal partner can also help you weigh the pros and cons of each path to profit, such as leasing versus selling, based on current market conditions and long-term goals.

Title Search

Before you can proceed with any agreements or development, it’s critical to confirm you legally own the mineral rights associated with your land. A thorough title search traces ownership history, revealing any prior transfers, leases, or encumbrances.

- Verification Process: This includes examining property deeds, county land records, and historical filings.

- Red Flag Detection: A title search helps identify issues such as liens or disputed claims that could hinder your ability to benefit from oil extraction.

- Professional Support: Given the complexity involved, working with a title expert or land services company is recommended for accurate and efficient results.

Quality and Quantity Assessment

Once legal ownership is verified, the next step is evaluating the economic potential of your oil discovery. Not all oil is created equal, and neither are the reserves beneath your property.

- Technical Evaluation: Engage geologists and petroleum engineers to conduct seismic testing, core sampling, and well analysis.

- Market Value: Higher-grade oil commands better prices and is easier to refine, making quality just as important as quantity.

- Feasibility Planning: A detailed study will help you decide whether to pursue development, lease the rights, or sell them—each offering unique risks and returns.

Whether you’re planning to develop or divest, getting expert legal and technical support is a crucial part of what to do if you find oil on your land. It ensures your decisions are informed, strategic, and aligned with both your rights and long-term financial goals.

Exploring What to Do If You Find Oil on Your Land

Once you’ve confirmed ownership of your mineral rights, it’s time to consider what to do if you find oil and how to turn that discovery into financial gain. Whether you’re seeking passive income, a lump-sum payout, or active involvement in development, there are several viable paths. Below, we break down the most common and potentially lucrative opportunities.

Leasing Your Mineral Rights After Finding Oil

One of the most straightforward answers to what to do if you find oil on your land is leasing your mineral rights to an oil company. This option allows you to retain ownership while granting the company the right to explore and extract the oil.

Partnering with oil companies through a lease agreement can be highly profitable and relatively low-risk. In return for access to your land’s underground resources, the company typically provides:

- Signing Bonuses: An upfront payment based on market value, property size, and negotiated terms.

- Royalties: Ongoing payments based on a percentage of the revenue generated from the extracted oil. These can range from 12.5% to 25%, depending on the lease agreement.

Leasing is ideal for landowners who prefer steady income without the complexities of managing an extraction operation. However, it’s essential to negotiate favorable lease terms, understand your long-term obligations, and protect your property rights.

Selling Your Oil and Mineral Rights for Immediate Income

If you’re seeking a faster financial return or want to avoid the ongoing responsibilities of mineral ownership, selling your mineral rights is another strong option when deciding what to do if you find oil.

You can choose to sell:

- All of your rights: Transferring full ownership to the buyer.

- A portion of your rights: Retaining partial ownership and some control over future profits.

This strategy provides a lump-sum payment, which can be especially attractive if you need immediate capital or want to reduce exposure to oil market fluctuations.

Keep in mind, selling requires due diligence. Research market trends, gather multiple offers, and consult professionals to ensure you’re getting fair value. If you’ve recently found oil on your property, you may be in a strong position to negotiate a high-value deal.

Investing in Oil Extraction on Your Land

For those willing to take on more responsibility and risk, participating in the development of your oil reserves could result in the highest financial return.

By holding a working interest, you become a co-investor in the drilling and production process, sharing both the profits and the expenses. This model offers:

- Greater control over decisions and operations

- A larger share of long-term revenue

- Deeper involvement in project planning and management

However, this path requires a significant financial and time commitment. You’ll be responsible for upfront and ongoing costs, including equipment, labor, and maintenance, along with potential tax obligations.

Still, if the reserves are substantial and of high quality, this approach could result in millions in revenue over time, making it a compelling option for the right landowners.

Environmental and Economic Implications if You Find Oil on Your Land

Before making any decisions about how to proceed with an oil discovery on your property, it’s important to consider both the environmental and economic implications. If you’re wondering what to do if you find oil on your land, evaluating these broader impacts will help you make more informed, responsible, and profitable choices.

Environmental Considerations

Drilling for oil has significant environmental impacts, and understanding how to mitigate them is key to responsible development. If you’ve recently found oil on your property, here’s what to keep in mind:

- Regulatory Compliance: Oil drilling is subject to strict environmental regulations at federal, state, and local levels. These laws aim to protect natural resources and reduce environmental damage. Compliance is critical to avoid costly penalties or shutdowns. Working with environmental consultants and legal professionals can help you stay on track.

- Environmental Impact Assessments (EIA): Conducting a thorough EIA is a vital step before starting any drilling operations. These assessments analyze how oil development could affect local ecosystems, including air, water, and wildlife. For landowners trying to determine what to do if you find oil on your land, understanding these impacts early can guide more responsible and efficient decision-making.

- Mitigation Measures: Implement technologies and strategies that reduce surface disruption, manage waste, and protect water resources. A strong environmental management plan will help balance resource extraction with long-term land sustainability.

- Community and Public Relations: Oil projects can influence community opinion. Being transparent about safety and sustainability measures can ease concerns and build support. If you find oil on your land, building goodwill with neighbors and local officials can also help smooth the permitting process.

Economic Benefits

While considering environmental implications, it is equally important to weigh the economic benefits of oil extraction. Understanding the financial aspects will help you make a balanced decision.

- Revenue Generation: One of the primary economic benefits of oil extraction is the potential for significant revenue generation. If the oil reserves are substantial and of high quality, the financial returns can be substantial. Assessing the market value of the oil and projecting potential earnings is essential to gauge the economic viability of the project—especially when deciding what to do if you find oil on your land.

- Job Creation and Economic Growth: Oil extraction projects can create jobs and stimulate economic growth in the local community. Additionally, supporting industries such as transportation, equipment manufacturing, and services can benefit from increased economic activity. The influx of jobs and business opportunities can boost the local economy and improve living standards.

- Financial Investment and Risk: Engaging in oil extraction involves significant financial investment and inherent risks. Drilling operations require substantial capital for equipment, labor, and regulatory compliance. It is important to conduct a thorough cost-benefit analysis to determine the project’s financial feasibility. Landowners evaluating what to do if you find oil on your land must consider risks such as fluctuating oil prices, operational challenges, and environmental compliance.

- Long-Term Economic Impact: Beyond immediate financial returns, consider the long-term economic impact of oil extraction on your property and community. Sustainable management of oil resources can provide ongoing revenue and economic stability. However, it is important to plan for the eventual depletion of the oil reserves and explore diversification opportunities to ensure continued economic prosperity. Investing in renewable energy projects or other industries can help create a resilient and diversified local economy.

Discovering oil on your property can be transformative, offering the promise of significant financial rewards. However, the journey from discovery to profit is complex and requires careful navigation through legal, financial, and environmental considerations. By understanding your mineral rights, seeking professional legal guidance, and thoroughly assessing the viability of your oil reserves, you can make informed decisions that maximize your benefits while minimizing risks.

Balancing the potential economic gains with responsible environmental practices is crucial. By addressing regulatory requirements and community impacts, you can ensure sustainable and profitable oil extraction. With the right approach and expert support, your oil discovery can lead to substantial and lasting rewards.